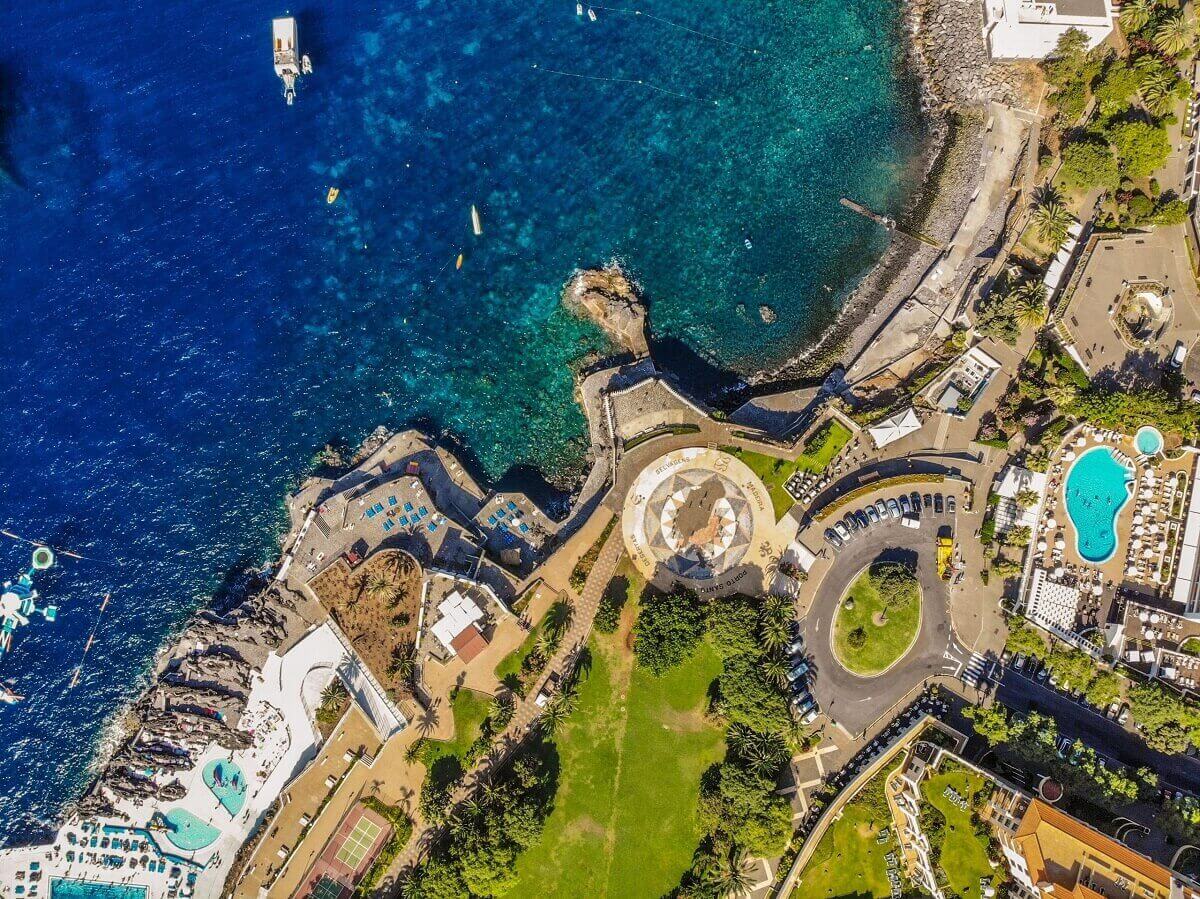

As I mentioned in the first article, this second article will focus on a brief analysis of the property market in Portugal, with a special focus on Madeira Island.

Why Madeira Island, and why investors should really start looking into Madeira Island as a new focal point for the real estate investment through Golden Visa?

First of all, with the approval of Decree-Law no. 14/2021 of 12 February, one of the most important changes to take place in the Golden Visa program was the limitation of real estate investment destined for housing, to be carried out only in the Autonomous Regions of the Azores and Madeira or in inland territories, identified in the annex to Ordinance no. 208/2017, of 13 July.

This means that due to the legislative changes, as of January 1st 2022, a great part of the Portuguese territory, including bigger cities like Lisbon, Porto and many of the costal areas will be excluded from the Golden Visa investments in what respects to habitational properties, and in what concerns to real estate investment within the scope of the Golden Visa program, Madeira Island will be one of the most interesting territories with the highest market value.

Second, how better to explain and summarize all the reasons to live and invest in Madeira than through this article on 15 reasons to live in Madeira when this is over.

The property market in Madeira Island has had stable growth over the last five years, and continues to grow, with a progressive increase in value per square meter, from €1,160 in February 2016 to a current value of €1,749 in February 2021.

As you can see from the graph provided by the Idealista website, the average value of the property has been increasing consistently, with a considerable increase of 12,8% only between July 2020 and February 2021, in the midst of the pandemic crisis.

In comparative terms over the same period between July 2020 and February 2021, the real estate value of the square meter in Lisbon increased by 4.8%, in Porto by 5.6% and in Faro by 3.3%.

This means that overall, amid the pandemic crisis the value of the real estate market has been rising, but with a special focus on the Madeira Island.

The same situation is verified at the level of the rental market, with a permanent increase in the square meter value for rental purposes in Madeira Island, with an increase of 6.4% between June 2020 and February 2021. Currently the value per square meter on the rental market is valued at €8.3 per square meter, on average for Madeira Island.

The same cannot be said in relation to Lisbon and Faro, which had a decrease, and in relation to Porto the increase in those periods was only 1%.

However, in general terms, the property market in Portugal has shown signs of maintaining a certain stability in its growth, with a certain dynamism in demand and supply, the result of a readjustment in the way of living in Portugal.

Even with interest rates at very low levels for credit to buy property, the rental market has recently seen a surprising amount of demand for the insufficient supply on the market.

The case of Funchal, capital of the Madeira district, is a clear example of a shortage of supply in terms of the rental market, with a clear difficulty in responding to the constant increase in demand.

In Portugal there has been a growth in property investment through the construction or rehabilitation of real estate for rent, and it is currently a solid investment, as can be seen in the analysis made in the article by CRBE consultants.

One of the main reasons for this search for a more flexible long-term rental is urban migration and the search for a first home by the younger population, where we would include the digital nomads or younger independent workers that can provide their services from any place on the world.

It should not be forgotten that although remote working was one of the most impactful circumstances during the Covid19 pandemic, people and businesses still want and demand to be close to the best infrastructure, social and cultural activities, as well as access to the best services and healthcare.

Therefore, using the real estate investment to obtain the Golden Visa, being able to monetize the acquired property for the rental market, or even using the rehabilitation of properties over 30 years old or in rehabilitation areas, to be later refurbished and put on the rental market, proves to be a safe and sensible investment in the near future.

In the specific case of Madeira Island, whether the investment is in the perspective of urban rental, or in the use of the property for tourism activities, there will always be a return on the property during the five-year period in which it will be mandatory to maintain the investment.

Even after this five-year period, what the market has shown is that the investment in real estate for long or short term rental is effectively a market with great possibilities of financial return.

auctor – Pedro Marrana

The founding of Madeira Corporate Services dates back to 1996. MCS started as a corporate service provider in the Madeira International Business Center and rapidly became a leading management company… Read more