The personal income tax system in Portugal is sometimes challenging to grasp; that is why we have prepared this article summarizing the key aspects of the Portuguese tax system.

How does the Tax System in Portugal Work?

The Basics

The Portuguese tax system consists of national (or regional) and municipal taxes, generally calculated based on income, expenditure, and property ownership.

Foreigners living in Portugal must register as taxpayers before they can start generating income, even if they can apply for tax benefits and exemptions. Registration as a taxpayer can be done by the taxpayer themselves or by a lawyer acting at the local tax office with jurisdiction over the taxpayer’s residential address (if applicable).

The Portuguese tax year runs alongside the calendar year (from 1 January to 31 December).

The Personal Income Tax System in Portugal

Personal income taxation in Portugal is set, at the national level, by the Assembly of the Republic, with the Legislative Assemblies of the Autonomous Regions of Madeira and Azores having the power to adapt the national tax rates applicable to those residing in the Autonomous Regions. Given that both Autonomous Regions are the European Union’s outermost regions, the tax rates applicable to personal income tax are lower than those applicable to mainland residents.

Considering the above, the tax system in Portugal is worldwide income-based, which means that should you qualify as a resident, for tax purposes, you will be taxed on the income you have generated worldwide, not the income solely generated in Portuguese territory. Under this system, the Portuguese Tax and Customs Authority will also consider any tax credits granted under the double taxation agreements signed between Portugal and the jurisdictions of the source of income.

For those qualifying as non-residents, personal income tax is levied only if income is generated in Portugal.

Tax Residency Rules

Under Portuguese tax laws, one is deemed resident, for personal income tax, purposes if in the year respective of the earnings:

- Have remained in Portugal for more than 183 days, consecutive or alternate, in any 12 months starting or ending in the calendar year at stake;

- Having remained for less time, maintained property in Portugal, in any given period of the period mentioned above, under such conditions that may lead to the inference of an intention to occupy the property as a regular place of residence;

- On 31 December, is a crew member of a ship or aircraft provided that such person is employed by entities having their domicile, head office or effective management in Portuguese territory;

- Exercises functions or commissions of public character under the Portuguese State, abroad.

Tax Residency Rules in the Autonomous Regions of Madeira and the Azores

One is deemed to be resident in an Autonomous Region in the year the income relates when they remain in the respective territory for more than 183 days.

Nevertheless, for a resident in Portuguese territory to be considered a resident in an Autonomous Region, this region must be where they have their habitual residence and is registered there for tax purposes. When it is not possible to determine the permanence referred previously, residents in Portuguese territory who have their main centre of interests there are considered to be residents in the territory of an Autonomous Region, and the place where the major part of the taxable income is obtained, determined in the following terms, is considered to be such:

- Employment income is deemed to be obtained at the place where the activity is provided;

- Business and professional income is considered to be obtained at the place of establishment or of habitual exercise of the profession;

- Capital income is deemed to be obtained at the place of an establishment to which the payment is attributable.

- Income from land and increases in wealth deriving from the immovable property shall be deemed to have been obtained at the place where the property is situated.

- Income from pensions shall be deemed to be obtained at the place where they are paid or made available.

The persons who constitute the household are deemed to be residents in the territory of an autonomous region, provided that the main centre of interests is located there, under the terms defined above.

The Tax System in Portugal for Expats

Some ex-pats living in Portugal can take advantage of the Non-Habitual Residency (NHR) scheme, which provides substantial exemptions for ten years of residence. This special ex-pat tax status is available to all those relocating to the country, regardless of their nationality and where they qualify as pensioners, workers or freelancers (digital nomads).

Before relocation, one should contact a tax advisor, such as MCS and have your income structure analyzed concerning its compliance with the NHR scheme rules and exemptions.

Tax Rates In Portugal

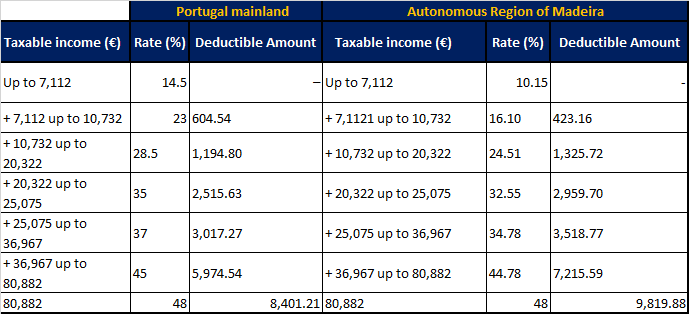

Portugal has a progressive tax system in place, where different tax rates apply to different tax brackets.

Income Tax Brackets in Portugal and the Autonomous Region of Madeira for the FY2021

Portuguese income taxes apply to earnings in the following six categories:

- A: Employment income

- B: Self-employment income

- E: Investment income

- F: Rental income from properties let in Portugal

- G: Capital gains from selling properties, assets, or shares

- H: Pensions in Portugal, including private pension plans

Special and/or fixed tax rates may apply to different categories of income depending on specific types of income, tax residency status or applicability of the NHR scheme to the taxpayer in question.

Tax Reporting Obligations

All taxpayers that generate income in Portuguese territory between 1 January and 31 December must prepare and file personal income tax returns. These tax returns are filed online, usually between 1 April and 30 June of the following calendar year.

Penalties for late returns can be anywhere from €200 to €2,500.

Taxation of Income from Blacklisted Jurisdictions

Capital income (interests and dividends) paid out by jurisdictions blacklisted by the Portuguese Ministry of Finance are taxed at a flat rate of 35%.

The current list of blacklisted jurisdictions is as follows: American Samoa, Liechtenstein, Maldives, Anguilla, Marshall Islands, Antigua and Barbuda, Mauritius, Aruba, Monaco, Ascension Island, Monserrat, Bahamas, Nauru, Bahrain, Netherlands Antilles, Barbados, Northern Mariana Islands, Belize, Niue Island, Bermuda, Norfolk Island, Bolivia, Other Pacific Islands, British Virgin Islands, Palau, Brunei, Panama, Cayman Islands, Pitcairn Island, Channel Islands, Porto Rico, Christmas Island, Qatar, Cocos (Keeling), Queshm Island, Iran, Cook Islands, Saint Helena, Costa Rica, Saint Kitts and Nevis, Djibouti, Saint Lucia, Dominica, Saint Pierre and Miquelon, Falkland Islands, Samoa, Fiji, San Marino, French Polynesia, Seychelles, Gambia, Solomon Islands, Gibraltar, St Vicente and the Grenadines, Grenada, Sultanate of Oman, Guam, Svalbard, Guyana, Eswatini, Honduras, Tokelau, SAR Hong Kong (China), Trinidad and Tobago, Jamaica, Tristan da Cunha, Jordan, Turks and Caicos Islands, Kingdom of Tonga, Tuvalu, Kiribati, United Arab Emirates, Kuwait, Virgin Islands of the United States, Labuan, Vanuatu, Lebanon, Yemen, Liberia.

This article is provided for general information purposes only and is not intended to be, nor should it be construed as, legal or professional advice of any kind.

Laurinda holds a Diploma in Business Administration from the South African Institute of Administration and Commerce… Read more