A Taxation Big Brother

Automatic exchange of information (AEOI or routine exchange) is actual and is legislated within the European Union, and the Autonomous Region of Madeira is part of it.

A prevalent misperception is that foreign nationals may choose where to pay taxes. If you spend more than 183 days in Portugal in a given year, the Portuguese government considers you a tax resident of the country, and therefore you must file and pay taxes there on your worldwide income.

The number of AEOIs between the Portuguese Tax and Customs Authority (AT) and the tax administrations of other countries increased by 19% in 2021 compared to 2020. A total of 5,217 215 automatic exchanges of information occurred in 2021 alone.

Also, in 2021, concerning automatic information exchanges on direct taxes (personal income tax and corporate income tax), the AT received 1 617 965 from the tax administrations of other countries – about 20,000 more than in 2020.

Automatic Exchange of Information: how it works

In Portugal, and therefore Madeira, the automatic exchange of information concerning personal or corporate income is regulated under Decree-Lei n. 64/2016. Thus transposing European Directives on the matter.

Since 2011, the EU has had a system for exchanging tax and financial account information between Member States. Tax authorities in the EU also agreed to cooperate closely to tax their taxpayers correctly and combat tax fraud and tax evasion.

The Directive covers all taxes except VAT, customs charges, excise duties, and compulsory social contributions, which are handled by other Union administrative cooperation laws. In addition tax debt collection has its own laws.

The abovementioned Directive applies to EU residents who are natural people, legal persons, or other legal structures like trusts and foundations.

What type of AEOIs are there? What information is exchanged?

The Directive provides for the exchange of specified information in three forms: spontaneous, automatic and on request.

- Spontaneous exchange of information takes place if a country discovers information on possible tax evasion relevant to another country, which is either the country of the income source or the country of residence.

- Exchange of information on request is used when additional information for tax purposes is needed from another country.

- Automatic exchange of information is activated in a cross-border situation, where a taxpayer is active in another country than the country of residence. In such cases tax administrations provide automatically tax information to the residence country of the taxpayer, in electronic form on a periodic basis. The Directive provides for mandatory exchange of five categories of income and assets:

- employment income,

- pension income,

- directors fees,

- income and ownership of immovable property and life insurance products

- Cross-border tax rulings and advance pricing arrangements

- Country by country reporting and tax planning schemes.

- Other Forms of Administrative Cooperation: The Directive provides for other means of administrative cooperation such as the presence of officials of a Member State in the offices of the tax authorities of another Member State or during administrative enquiries carried out therein. It also covers simultaneous controls allowing two or more Member States to conduct simultaneous controls of person(s) of common or complementary interest, requests for notifying tax instruments and decisions issued by the authority of another Member State.

The above based on the common global standards agreed by tax administrations at international level, notably at the OECD. However, they sometimes go further and importantly they are legislative rather than being based on political agreement without legislative force.

In addition the Directive provides for a practical framework to exchange information – i.e. standard forms for exchanging information on request and spontaneously, as well as computerised formats for the automatic exchange of information – secured electronic channels for the exchange of information and a central directory for storing and sharing information on cross-border tax rulings, advance pricing arrangements and reportable cross-border arrangements (“- tax planning schemes”).

Finally, EU-Member States are also required to provide a feedback to each other on the use of information received, and to examine together with the Commission how well the Directive supports the administrative cooperation.

In addition and according to the OECD, the most frequently exchanged income types are: interest, dividends, royalties, income from dependent services and pensions. All OECD 38 countries (100%) receive information automatically from treaty partners and 33 (85%) of them send information automatically to treaty partners.

AEOI and CRS

The AEOI issue is more “serious” if we take into account that banks now collect and report information on bank account balances held by non-resident (for tax purposes) clients to the tax authorities. The opposite also happens: foreign banks will report the accounts held by taxpayers resident in their national territory to their respective tax authorities, who will then communicate this information to the tax authorities of the country of origin from which the taxpayer comes from.

This exchange of information stems from the implementation of the Common Reporting Standards (“CRS”), created by the OECD, and of which Portugal and 92 other countries are participating members. Among these 93 jurisdictions, offshores like the Cayman Islands, the British Virgin Islands, Channel Islands are also participating.

Like AEOI under EU-law, the CRS aim to combat tax evasion and money laundering and can have an impact on the tax residency status of thousands of expats.

Therefore, expats’ income to be taxed in their country of origin and in their country of residence, if tax residence status are not up to date in all jurisdictions. After all one cannot be resident, for tax purposes, several jurisditions at the same time.

AEOI is involving and will soon reach crypto income

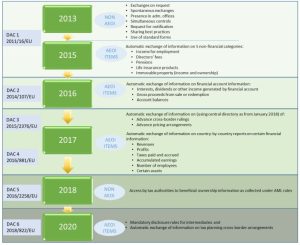

Exchange of information between tax authorties concerning personal and corporate income has been evolving since 2013, and will soon reach those earning crypto income, under the so called DAC8 directive. The European Commision aims to: “expand the reporting and exchange of information between tax authorities within the EU to cover income or revenue generated by users residing in the EU while operating with crypto-assets.”

There is no point in hidding

To avoid any audit within OECD countries, expats relocating to Madeira on a permanent basis must:

- Legally reside in Portuguese territory

- Update their tax status, becoming residents in Portuguese territory and therefore liable to wordlwide taxation under Portuguese law

- Inform their country of origin and of nationality that they are no longer residents, for tax purposes.

- Apply, if possible for NHR status (a ten-year tax holiday on foreing income), in Portugal if they meet the requirements.

Any other situation that is different from the above, such as being registered as resident for tax purposes in more than one jurisdiction or failing to report income in the jurisdiction where one residets not only constitutes a tax crime punishable under law, but also ignities the likelihood of an AEOI. Situations that one must avoid at all costs.

So the next time, your tax consultant advises you to follow the above steps is in order for you to be a law abiding resident not only in Portuguese territory but also in the jurisdictions where you generate income.

At MCS, we can assist you with your tax and immigration matters in Madeira Island and mainland Portugal. This article is provided for general information purposes only and is not intended to be, nor should it be construed as, legal or professional advice of any kind. Should you have any questions, please do not hesitate to contact us.

Miguel Pinto-Correia holds a Master Degree in International Economics and European Studies from ISEG – Lisbon School of Economics & Management and a Bachelor Degree in Economics from Nova School of Business and Economics. He is a permanent member of the Order of the Economists (Ordem dos Economistas)… Read more