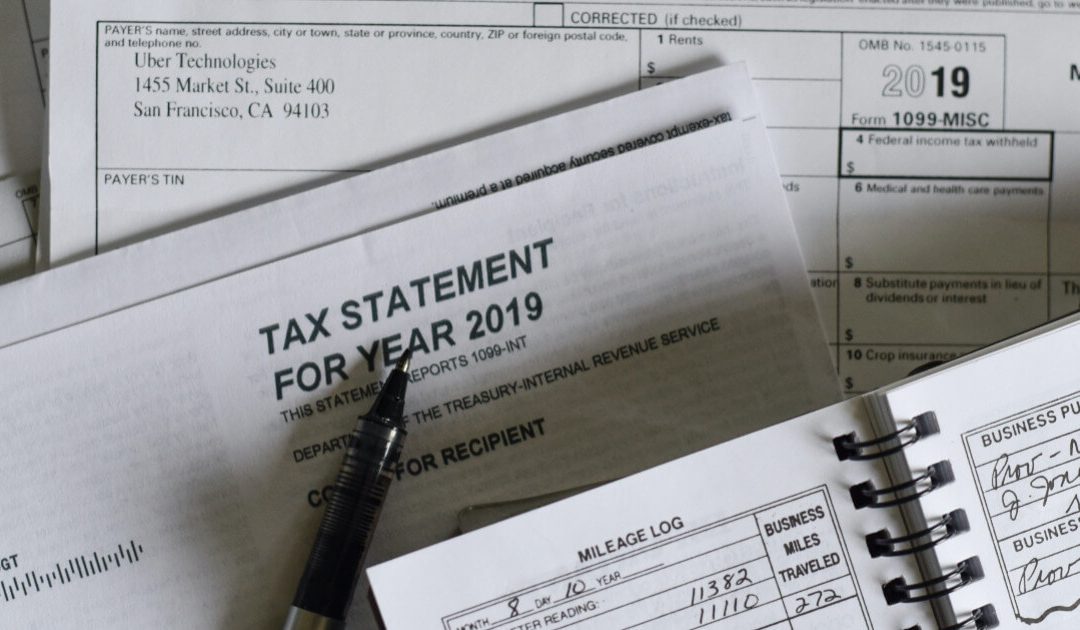

If one is considering settling in Madeira Island, or already settling as a resident, then one must hire an accountant in Madeira. Did you know that you might be liable to tax reporting obligations and potentially tax patients as a legal resident? 1. Obtaining tax...