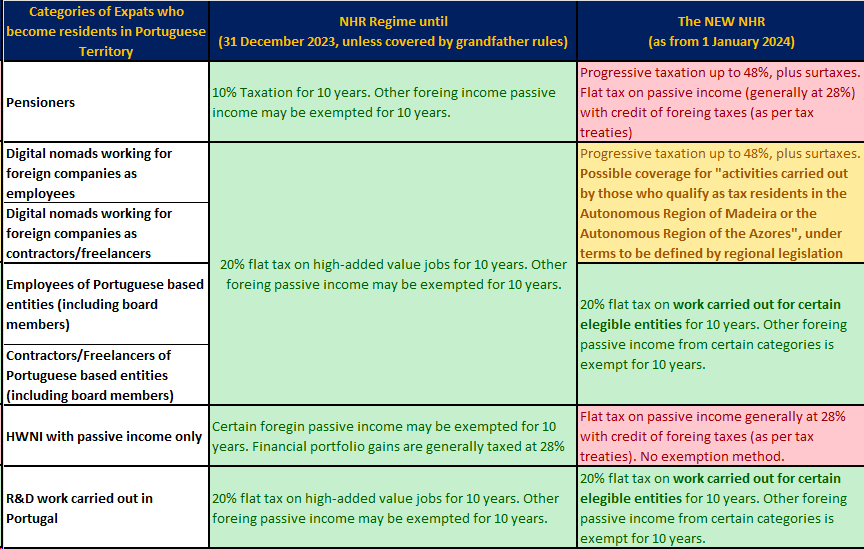

The NHR, as it has been understood for several years, is set to expire on December 31, 2023. In its place, a new regime will take effect on January 1, 2024 (with some stakeholders already calling it “NHR 2.0”, “the New NHR”), which will mirror the majority of the NHR’s benefits (except for those on pension income). However, it will affect a different group of beneficiaries.

Nevertheless, if you desire continued access to the “old NHR” beyond December 31, 2023, you will be required to determine whether you qualify for one of the grandfathering provisions detailed below:

- Possessing a process in place to obtain a residence visa or residence permit, which must be commenced by December 31, 2023, with the appropriate authorities in adherence to the prevailing immigration legislation, specifically by means of arranging an appointment or making an appointment to apply; alternatively, by applying for a residence visa or residence permit; or

- Possessing a legitimate residence permit or visa until December 31, 2023; or

- Possessing a signed employment contract, promise, or secondment agreement by December 31, 2023, with the obligations of the individual being conducted exclusively within the borders of the nation or

- Having a lease agreement or similar contract that authorises the use or possession of real estate within Portuguese territory until the expiration of October 10, 2023, or

- Having executed a reservation agreement or promissory deed for the purchase of tangible property rights on Portuguese soil by October 10, 2023, or

- By October 10, 2023, have all dependents enrolled in an educational institution domiciled in Portuguese territory.

To clarify, taxpayers enrolled as NHR on December 31, 2023, including current NHR beneficiaries, will continue to be eligible for the regime’s benefits for the next ten years.

As for the new NHR, it is possible to predict that this regime will remain in effect for ten years and apply to individuals who acquire tax residency in Portugal after not residing there for the preceding five years. The new NHR will impose a 20% tax on employment and freelancer income in lieu of the current high-added job value criteria. Several categories of foreign-sourced income, including dividends, interest, capital gains, and rents, will be exempt from the tax.

It is anticipated that the new programme will have a broader scope, especially for those who become tax residents in the Autonomous Region of Madeira and conduct business or other investment activities there; additional information will be provided in a regional decree that is forthcoming, as already announced by the President of the Regional Government of Madeira, Miguel Albuquerque.

The New NHR as an incentive for innovation

Starting from January 1, 2024, the new tax incentive offers a 20% flat rate for 10 years, along with a foreign income exemption (except for tainted income sourced in blacklisted jurisdictions). The list below outlines eligible activities (simplification) and adds some comments:

- Job positions or other activities carried out by tax residents in the Autonomous Region of Madeira or the Autonomous Region of the Azores.

- Teaching in higher education, scientific research and technology innovation centres provided that said work is carried out in institutions based in Portuguese territory;

- Qualified jobs and board members of entities receiving Portuguese contractual tax incentives signed with Portugal’s IAPMEI or AICEP – applicable to larger investments over €3 million;

- Highly qualified professionals working for entities benefiting from the Investment Promotion Tax Regime (RFAI);

- Highly qualified professionals working for entities that export at least 50% of their turnover;

- Qualified jobs and board members of entities deemed relevant for the Portuguese economy – under discretionary criteria to be applied by IAPMEI or AICEP;

- Research and Development personnel whose costs are eligible for the R&D tax incentive system (SIFIDE);

- Job positions and members of the governing bodies of entities certified as Start-Ups in Portugal. A start-up is defined, under Portuguese law as follows:

- Company with less than 10 years of activity;

- Less than 250 employees;

- Less than €50 million turnover;

- Not held by a large company;

- Based in Portuguese territory or have more than 25 employees;

- Be an innovative company; or have one round of VC financing; or investment from Banco Portugês de Fomento.

Summary of the legislation approved

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as legal, financial, or investment advice. The information provided in this article is subject to future updates in light of the recent legislative changes. Please consult with our professionals who specialise in Portuguese taxation before making any tax-related decision.

The founding of Madeira Corporate Services dates back to 1996. MCS started as a corporate service provider in the Madeira International Business Center and rapidly became a leading management company… Read more