Are you considering company formation in Portugal? If yes, our team of professionals has come up with the following tips concerning company formation in Portugal so that you can make a more informed decision regarding your business.

Company Formation in Portugal and taxation

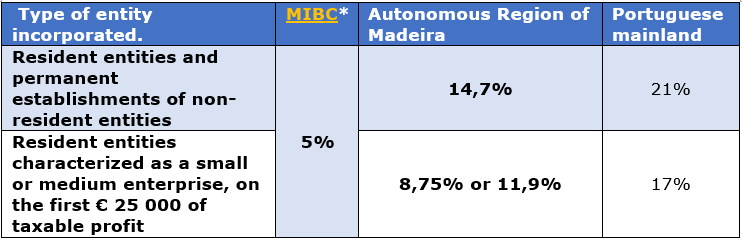

The corporate tax rate applicable to companies in Portugal may vary, depending on which part of the Portuguese territory said companies are incorporated and domiciled. From the get-go, the Autonomous Region of Madeira is the Portuguese territory with the highest tax efficiency for companies and investors.

* Incorporation of entities within the MIBC – Madeira International Business Center allows for a 5% tax rate that is only applicable on taxable profit deriving from non-resident entities (otherwise, the standard rates apply), along with additional tax benefits for shareholders. For more detailed information, please click here.

Further to the above, small and medium enterprises located in the Madeiran municipalities of Santana, Porto Moniz, São Vicente, and Porto Santo will have their corporate tax rates reduced to 8,75% instead of the standard 11,9%.

Documents needed

The documents needed for company formation in Portugal may vary slightly depending on the path chosen for incorporation. Should you engage legal assistance, such as the one provided by our professionals, you ought to expect being requested at least the following documents concerning the company’s UBOs, shareholders and directors:

- Passport/ID (only if EU Citizen);

- Government-issued document stating proof of address;

- Tax Identification Number;

- Proof of profession/payslip;

- Bank or Lawyer reference letter;

- CV duly signed;

Requesting the above documents is industry practice in light of EU law, namely EU Directive 849/2015 concerning anti-money laundering and counter-terrorism financing.

Tailor-made companies

Although speedy incorporation is possible, as the government has reduced bureaucracy regarding company incorporation, most foreign investors prefer to engage in the process of tailor-made company formation. This process gives complete control over the company name, the draft of statutes and other legal details that the quick government-provided path does not.

As such, and generally speaking, for one to incorporate a company in Portugal, the following steps need to be followed:

- Verify the business name and make a reservation with the Portuguese Commercial Register.

- Appoint a legal representative for the company in Portugal.

- Draft the Articles of Association with information about the owners, business activities, etc.

- Open a bank account for depositing the share capital.

- Apply for licenses and permits under the company’s activities.

- Register for tax purposes and social contributions in Portugal.

Those looking into incorporating a company within the MIBC must apply for a MIBC license. The license’s application (to be submitted in the Portuguese language) must be filed to Sociedade de Desenvolvimento da Madeira, the official concessionaire of the MIBC, in two copies, addressed to the Cabinet of the Vice-President of the Regional Government of Madeira in the name of an existing company, in Portugal or abroad, or of a company to be incorporated. Branches of existing companies may also be licensed.

All relevant information concerning the activity to be performed by the company must be included in the license application, namely:

- Company name and address.

- Activity to be undertaken and respective NACE code (European nomenclature of the Economic Activity).

- The total value of the investment.

- Indication of the number of jobs to be created.

In the case of a successful application, the license is deemed to be granted in favour of the company once the applicant furnishes proof of the formation and registration of such company. All documents in support of the license application must be duly translated into Portuguese and legalized.

This article is provided for general information purposes only and is not intended to be, nor should it be construed as, legal or professional advice of any kind. Should you wish to incorporate a company in Madeira Island, please do not hesitate to contact us.

Ambrosio Jardim has, since 1998, worked mainly in the areas of commercial law (corporate, mergers and acquisitions, joint ventures, restructuring and planning), national and international tax law and real estate…. Read more