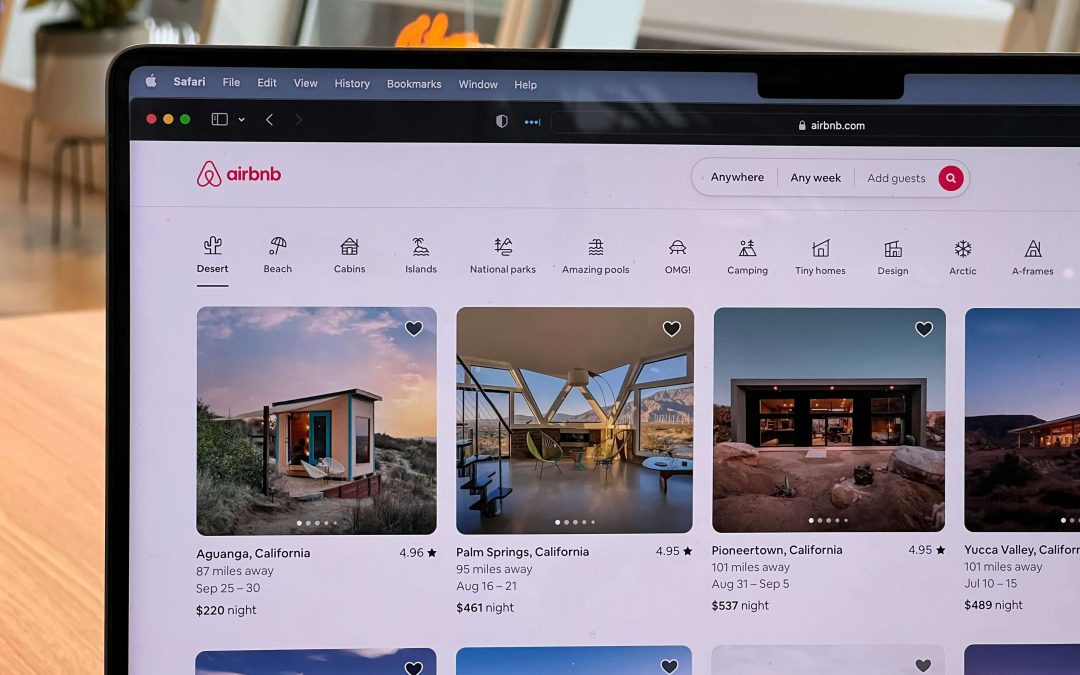

Local Accommodation Taxation in Madeira is a topic of growing interest among property owners and investors in the region. With Madeira’s flourishing tourism sector and favourable tax conditions, many are considering how best to structure their local accommodation...